Trends, events and developments in the UK energy sector.

(We used to produce an annual, in-depth Energy Outlook. But things are moving so fast these days that we decided a quarterly bulletin would be more useful. Here’s the summer edition.)

CLIMATE EMERGENCY >>

ENERGY TRENDS >>

WHAT IT MEANS FOR BUSINESS >>

CLEANEARTH NEWS >>

CLIMATE EMERGENCY

The climate debate has finally gone mainstream with a vengeance.

Greta Thunberg, David Attenborough, Extinction Rebellion …

The last few months have seen a seismic shift in public awareness and attitudes to climate change. The stark realities are no longer confined to the reports of academic researchers and advisory bodies such as the IPCC or CCC.

In large part this is down to the actions of two eloquent and passionate individuals – one aged 16 and the other 93 – who have put climate change firmly front and centre in the news media.

Sweden’s Greta Thunberg has been telling truth to power while mobilising her generation into collective action through a series of school strikes. And UK national treasure David Attenborough brought climate change to prime-time TV, describing it as “a man-made disaster of global scale”.

Meanwhile, thousands of Extinction Rebellion activists took their message to the streets of London (and many other places) through their programme of non-violent civil disobedience. For a movement that is barely a year old and runs on a decentralised, self-organising structure, XR has built some serious momentum.

Thanks to grass-roots activists in their thousands and a couple of high-profile individuals, the media – and parliament and business – can no longer dismiss climate change as an exaggerated threat or a niche issue for obsessives.

That genie is not going back in the bottle.

Global temperature records broken. Again.

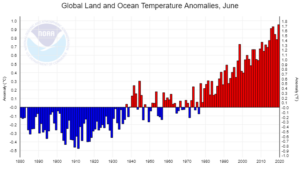

Globally, 2019 has given us the hottest June on record. July followed this with the hottest month on record – and the 415th consecutive month with temperatures above the 20th century average.

Globally, 2019 has given us the hottest June on record. July followed this with the hottest month on record – and the 415th consecutive month with temperatures above the 20th century average.

While India and Pakistan endured a 32 day heatwave, peak temperature records were re-written for much of western Europe. And wildfires raged across swathes of the Arctic, emitting as much CO2 in a month as Sweden does in a year.

Of course there was much hand-wringing about how much of this can be blamed on climate change, and most experts were rightly shy of making direct attributions. But the odds in favour of such extreme weather events are certainly increased on a warming planet. They will increase in frequency and the extremes will become more extreme.

It’s easy to be overwhelmed by the volume of news stories, reports, research papers, analysis and commentary on climate change. If you just want the latest headlines on global temperature, CO2, sea level and sea ice, these charts from Carbon Brief do a great job.

UK Government commits to net zero (but …)

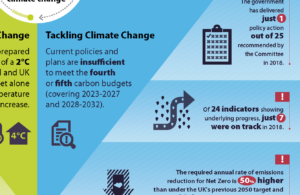

In early May the Committee on Climate Change recommended a new target of net zero greenhouse gas emissions by 2050. In mid-June Theresa May said parliament would take the CCC’s advice. And on 26 June the legislation was signed into law.

In early May the Committee on Climate Change recommended a new target of net zero greenhouse gas emissions by 2050. In mid-June Theresa May said parliament would take the CCC’s advice. And on 26 June the legislation was signed into law.

This made the UK the first major economy to commit to a zero emissions target.

While this was superficially good news, there was widespread scepticism that the government’s actions would match their rhetoric. And the activists at Extinction Rebellion were quick to claim that 2050 was far too late and we needed to be aiming for net zero by 2025 at the latest.

XR’s demands may appear extreme, but their alarm at the 2050 deadline was shared by many in the scientific community. In particular, a paper published in Nature showed that the existing and planned fossil-fuel infrastructure – power stations already in operation or committed for development – would emit more CO2 than the entire remaining carbon budget.

Their conclusion was that “little or no new CO2-emitting infrastructure can be commissioned, and existing infrastructure may need to be retired early” if we are to limit warming to 1.5C.

And the Committee on Climate Change, in their annual progress report, pointed out that action to curb emissions is already lagging behind what’s needed to meet our legally-binding targets. In the past year, the CCC states, “Government has delivered only 1 of 25 critical policies needed to get emissions reductions back on track”.

ENERGY TRENDS

Renewables’ upward trajectory continues – but more needs to be done.

Historic milestone as carbon-free power overtakes fossil fuels.

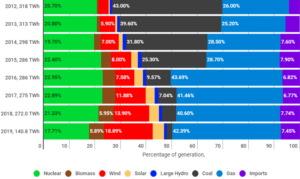

In the first five months of 2019 zero carbon sources provided 47.9% of our electricity, while fossil fuels provided 46.7% (the rest came from interconnectors with Europe). The National Grid predicts that 2019 will see carbon-free generation outstrip fossil fuels for the first time.

In the first five months of 2019 zero carbon sources provided 47.9% of our electricity, while fossil fuels provided 46.7% (the rest came from interconnectors with Europe). The National Grid predicts that 2019 will see carbon-free generation outstrip fossil fuels for the first time.

Q2 saw renewables generate almost double the electricity provided by nuclear power, while coal fell to a record low. Renewable generation rose 9% compared with the same quarter last year, totalling 23.1TWh. Of this, solar provided 4.42TWh – a rise of 18% on the same period in 2018.

In part this is being driven by renewable power getting cheaper, faster than expected. Price falls have exceeded the CCC’s projections, and new capacity in solar, offshore and onshore wind can currently be installed for as little as £56, £65 and £46 per MWh respectively – compared with £98 for new nuclear.

For a detailed look at how the UK’s electricity supply has been transformed in the last decade, Carbon Brief put together a comprehensive and brilliantly presented report that also looks ahead to “much greater change in the years to come”.

The analysts at Bloomberg take their own look into the future in the latest New Energy Outlook, predicting that wind power alone will account for 64% of the UK’s electricity generation by 2030.

Whether such projections prove to be accurate or not, there is no doubt that the decarbonisation of UK power needs to accelerate markedly if our net zero target is to be achieved.

HMRC pushes steep VAT increase for domestic solar-battery systems.

In a move that has outraged the renewables industry, HMRC has introduced legislation to quadruple the VAT levied on domestic solar and battery storage systems – from 5% to 20%. Coming on almost the same day as the net zero target was enshrined in law, it appears to contradict the government’s professed commitment to decarbonisation.

In a move that has outraged the renewables industry, HMRC has introduced legislation to quadruple the VAT levied on domestic solar and battery storage systems – from 5% to 20%. Coming on almost the same day as the net zero target was enshrined in law, it appears to contradict the government’s professed commitment to decarbonisation.

For solar PV installers already suffering from the withdrawal of the feed-in tariff, this will be a major deterrent to home-owners who might otherwise invest in carbon-free self-generation.

In a recent interview, the strategy director of Solarcentury, the UK’s largest solar company, was asked about government policy on incentives. “Residential solar needs ambition and a coherent joined-up policy,” he said. “There’s no point BEIS trying to create a market which takes no account of Treasury raising the VAT rate.”

A similar message came from Solarcentury’s CEO, who called for “security and clarity from the government” when asked about commercial and utility-scale solar deployment. “That’s the missing driver,” he said. “We need a level playing field. That’s when we can put the money to work, when there’s continuity.”

It seems the solar industry will need to keep lobbying hard to create conditions that encourage the adoption of carbon-free generation. And any business with green aspirations should add their voice to the clamour for a joined-up energy policy.

EV chargers now outnumber petrol stations.

Electric vehicle charging sites have exceeded the number of UK petrol stations. The number of EV charging locations reached 8,471 in May, compared with 8,400 petrol stations. While still well short of what is needed to meet the charging needs of even a small EV fleet, it’s a symbolic step on the way to electrifying UK transport.

Electric vehicle charging sites have exceeded the number of UK petrol stations. The number of EV charging locations reached 8,471 in May, compared with 8,400 petrol stations. While still well short of what is needed to meet the charging needs of even a small EV fleet, it’s a symbolic step on the way to electrifying UK transport.

There’s an obvious chicken-and-egg dilemma at the heart of EV growth, with new vehicle sales and charging point roll-out needing to be roughly in synch with each other. Despite this, momentum is building in both camps, with EV registrations now trebling year-on-year.

And the impact on the fossil fuel industries could be far greater and come far sooner than many were predicting only a few short months ago. A report from BNP Paribas predicts the long-term break-even price for petrol in transport will be around US$10 per barrel, and for diesel aroud $18 per barrel. This compares with the current price of Brent Crude at around US$60 per barrel.

As the report puts it, the “irresistible” economics of combining renewables with EVs will spell “the death toll for petrol”.

WHAT IT MEANS FOR BUSINESS

Environmental sustainabililty is driving the most sustainable businesses.

The opportunities are twice as big as the risks.

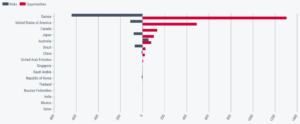

According to a report from CDP, the world’s largest companies believe the financial opportunities associated with climate change outweigh the risks by a margin of more than 2 to 1.

According to a report from CDP, the world’s largest companies believe the financial opportunities associated with climate change outweigh the risks by a margin of more than 2 to 1.

In response to CDP’s survey, businesses reported risks totalling an estimated US$970 billion. Over half were reported to be likely, very likely, or virtually certain within five years.

At the same time, they reported climate-related opportunities with a potential value of over US$2.1 trillion. This is expected to be driven by a demand for new carbon-free products and the competitive advantage of responding to shifting consumer preferences.

With the world’s multi-nationals seeing opportunity as well as risk in the warming climate, it’s little surprise that environmental sustainability now permeates all aspects of their business strategy. HSBC surveyed 2,500 Business Minds around the world for their July 2019 Navigator, revealing that 57% of those who plan to invest in innovative technology also plan to increase their spend on sustainability.

As HSBC Navigator describes it: “Sustainability has gone beyond being a luxury brand differentiator to become pivotal to long-term success, driven by competition, customer demand and … recruiting and retaining the best people.”

National Trust divests fossil fuel stocks from £1bn investment fund.

The National Trust is set to sell its holdings in fossil fuels, citing the failure of oil and gas companies to combat climate change by shifting to green alternatives. This follows similar moves by the Church of England and a growing number of UK councils and universities.

The National Trust is set to sell its holdings in fossil fuels, citing the failure of oil and gas companies to combat climate change by shifting to green alternatives. This follows similar moves by the Church of England and a growing number of UK councils and universities.

The European Investment Bank has also committed to end its financing for fossil fuel projects by the end of 2020, joining an accelerating move away from fossil fuel investment and into low-carbon products and services.

With $1.3 trillion under management, Legal & General Investment Management is one of Britain’s biggest fund managers. They’ve started selling shares in Exxon Mobil Corp., saying America’s largest oil company isn’t doing enough to address climate change.

A recent Clean200 report ranks the world’s largest publicly listed companies by revenue from clean energy products, and shows that the top 200 companies have collectively outperformed the S&P global 1200 energy index since 2016. (And this is despite the negative impact on Chinese stocks from the US/China trade war.)

Energy stocks currently make up 5% of the S&P 500 Index, down from 13% a decade ago.

It certainly looks like global capitalism has worked out which way the wind is blowing.

On-site self-generation – pioneering businesses come back for more.

Of those UK companies that already generate their own electricity, 81% are keen to increase their self-generation capacity. These early adopters are looking to reduce their exposure to risks of energy security and pricing volatility. They also recognise their customers’ growing demands for environmental responsibility.

Of those UK companies that already generate their own electricity, 81% are keen to increase their self-generation capacity. These early adopters are looking to reduce their exposure to risks of energy security and pricing volatility. They also recognise their customers’ growing demands for environmental responsibility.

This is from a report by Centrica Business Solutions, which found that businesses that take control of their own energy generation also tend to be the most economically sustainable and resilient. In the words of CBS sales director: “Our research shows that UK businesses are responding to market forces around environmental performance to ensure their long-term success.”

One major barrier to self-generation, however, is that businesses in rented premises simply assume that their landlord will not allow it. When Edie surveyed UK companies on the issue, they discovered the majority were finding it hard to even have the conversation with their landlord. As one respondent commented: “our local facilities managers believe that our landlords would not be open to these types of discussions. As a result, we never even have the conversations.”

While CleanEarth has recently enjoyed success in this regard (see the Accolade Wines story below), the benefits of self-generation – commercially and environmentally – are so great that this tenant/landlord barrier urgently needs addressing.

CLEANEARTH NEWS

Highlights and insights from the last few months at CleanEarth HQ.

Avonmouth wind turbine ‘first of its kind’.

Our latest wind turbine is the first in the UK to be built for a business that does not own the property the turbine has been built on. It may seem a subtle point, but the landlord/tenant issue has been a major barrier to businesses adopting renewables.

Most large enterprises lease their land and buildings, and they usually assume that their landlord won’t agree to a turbine because they won’t see any direct benefit.

As CleanEarth’s MD Dean Robson puts it, “we’ve talked to numerous businesses that would go for wind generation without hesitation, but because they don’t own the building they assume it’s a non-starter.”

The key to overcoming this barrier was collaboration.

The tenant, Accolade Wines, were determined to generate as much of their electricity as possible from carbon-free sources (their huge distribution centre is a power-hungry beast). They chose CleanEarth to deliver the turbine, and also worked hard with the managers of the property – Roebuck Asset Management – to make the case to the landlord.

In Dean’s words, “this was never going to be easy. But we knew that it was achievable with the right partner. It’s taken a lot of time and effort, but Accolade Wines and CleanEarth have achieved what many said could not be done. Hopefully this is the first of many.”

For full details of how the project was delivered, check out the case study and video.

Bringing solar power to the Welsh Valleys.

Once powered by coal from local collieries, the Welsh Valleys are increasingly turning to renewable energy to power their 21st century industries. We recently completed a 250 kW solar PV installation for Sharp Clinical’s European HQ in Rhymney, South Wales.

Once powered by coal from local collieries, the Welsh Valleys are increasingly turning to renewable energy to power their 21st century industries. We recently completed a 250 kW solar PV installation for Sharp Clinical’s European HQ in Rhymney, South Wales.

Sharp Clinical’s packaging, labelling and distribution facility houses refrigerated and frozen systems with hefty power demands, so on-site generation was an obvious way to reduce their bills and carbon emissions.

The key to making the project financially viable was striking the right balance between electricity demand and generating capacity. We looked at the load profile and designed an east-west array to avoid the midday peaks that south-facing systems create. This will maximise electricity consumption on-site and minimise export to the grid while supplying around 20% of the site’s requirements.

The system will save some 1,750 tonnes in carbon emissions over its 25-year lifespan, and will save Sharp Clinical around £1 million on its electricity bills.

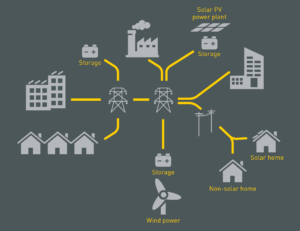

Why ‘behind the meter’ is ahead of the curve.

Dean Robson, CleanEarth’s MD, is convinced the full potential for ‘behind the meter’ generation is still untapped, and many more businesses could (and should) be taking advantage of the added security, flexibility, cost-control and carbon-reduction benefits that it provides.

Dean Robson, CleanEarth’s MD, is convinced the full potential for ‘behind the meter’ generation is still untapped, and many more businesses could (and should) be taking advantage of the added security, flexibility, cost-control and carbon-reduction benefits that it provides.

“It’s a complete no-brainer,” he says. “If your energy costs are a significant item on your P&L then you’ll be looking at ways to manage and reduce them. Electricity from the grid went up by 10 to 15 per cent between Q1 last year and this year. That’s a big hit to take.”

This cost volatility brings unwelcome risk to businesses who are high energy consumers. Self-generation can mitigate a large part of that risk. “We have customers who are getting a sizeable proportion of their electricity from solar or wind power at their premises. It costs them less – as little as 35% of grid costs in some cases – and that cost is fixed or index-linked for the next 25 years.”

While the technical and commercial aspects can appear daunting, the right partner will be able to cut through the complexities and quickly establish whether a viable business case can be made. “We’ve done this for companies of every shape and size,” says Dean. “Sometimes the numbers don’t add up, but more often businesses are shocked at what a difference it can make to their bottom line.”

As the need for decarbonisation becomes ever more urgent, environmental responsibility is also a growing concern for business. “We all need to act on this,” says Dean. “It’s no good leaving it to the big boys or the trailblazers. It’s everybody’s responsibility.”

Renewables provided one third of the UK’s electricity in 2018 and look set to exceed 50% in 2019. Much of this capacity is in large and utility-scale installations, but smaller standalone projects make a significant and growing contribution.

“There’s so much scope for decentralised generation at the point where the power is consumed,” Dean concludes. “We’ve barely scratched the surface of what’s achievable.”